Time Series Analysis

Methods for Real-World Forecasting

Jan 4, 2026

Introduction

- What is time series?

- Examples of time series data

- Why study time series?

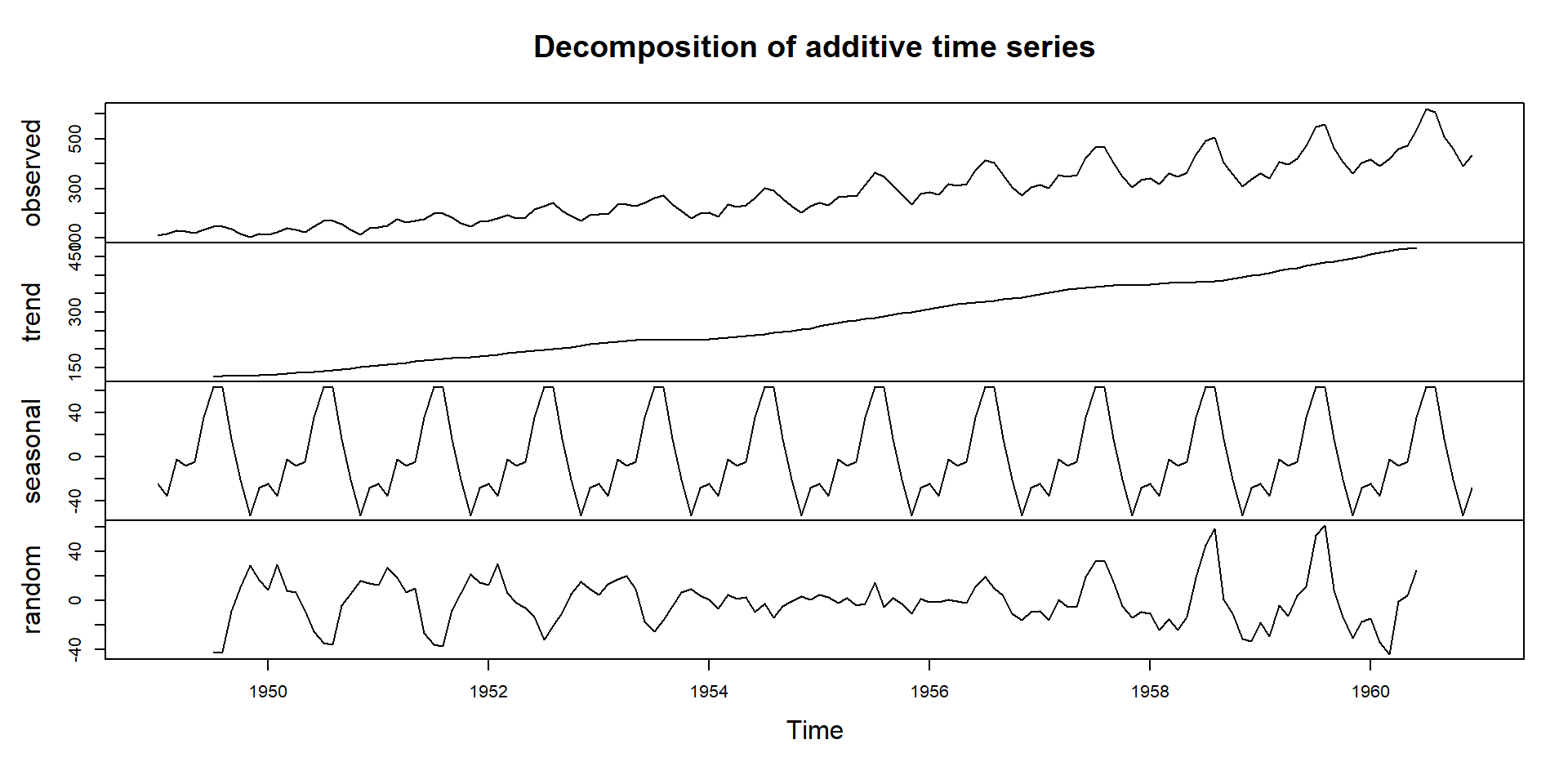

Components of time series

A time series can be decomposed into 4 components

- Trend

- long pattern of the series

- positive or negative

- Seasonal

- regular fluctuations in a specific frequency

- Cyclical

- up- down movement over longer periods

- typical business cycles in macroeconomics

- Irregular

- Unpredictable component

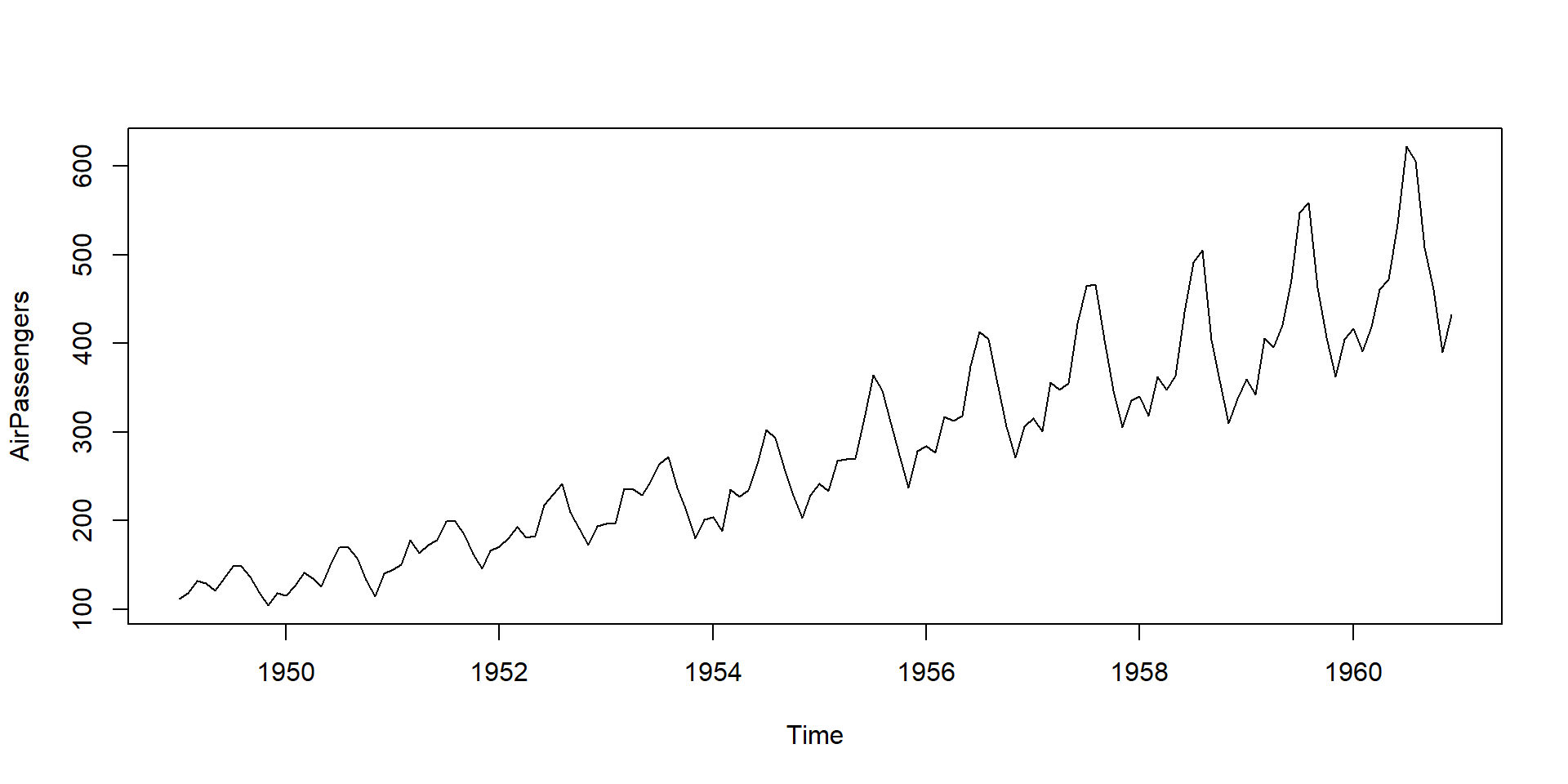

Working with R

Time series plot of air passengers data

Working with R

Time series decomposition of air passengers data

Stochastic Process

- a collection of time indexed random variables

- randomness

- time series is actually a realization from certain stochastic process

- stationary and non-stationary process

Stationary Stochastic Process

a discrete stochastic series is stationary if \[\begin{equation} \begin{aligned} &E\left(y_{t}\right)=\mu \\ &E\left(y_{t}-\mu\right)^{2}=\sigma^{2} \\ &E\left[\left(y_{t}-\mu\right)\left(y_{t+k}-\mu\right)\right]=r_{k} \end{aligned} \end{equation}\]

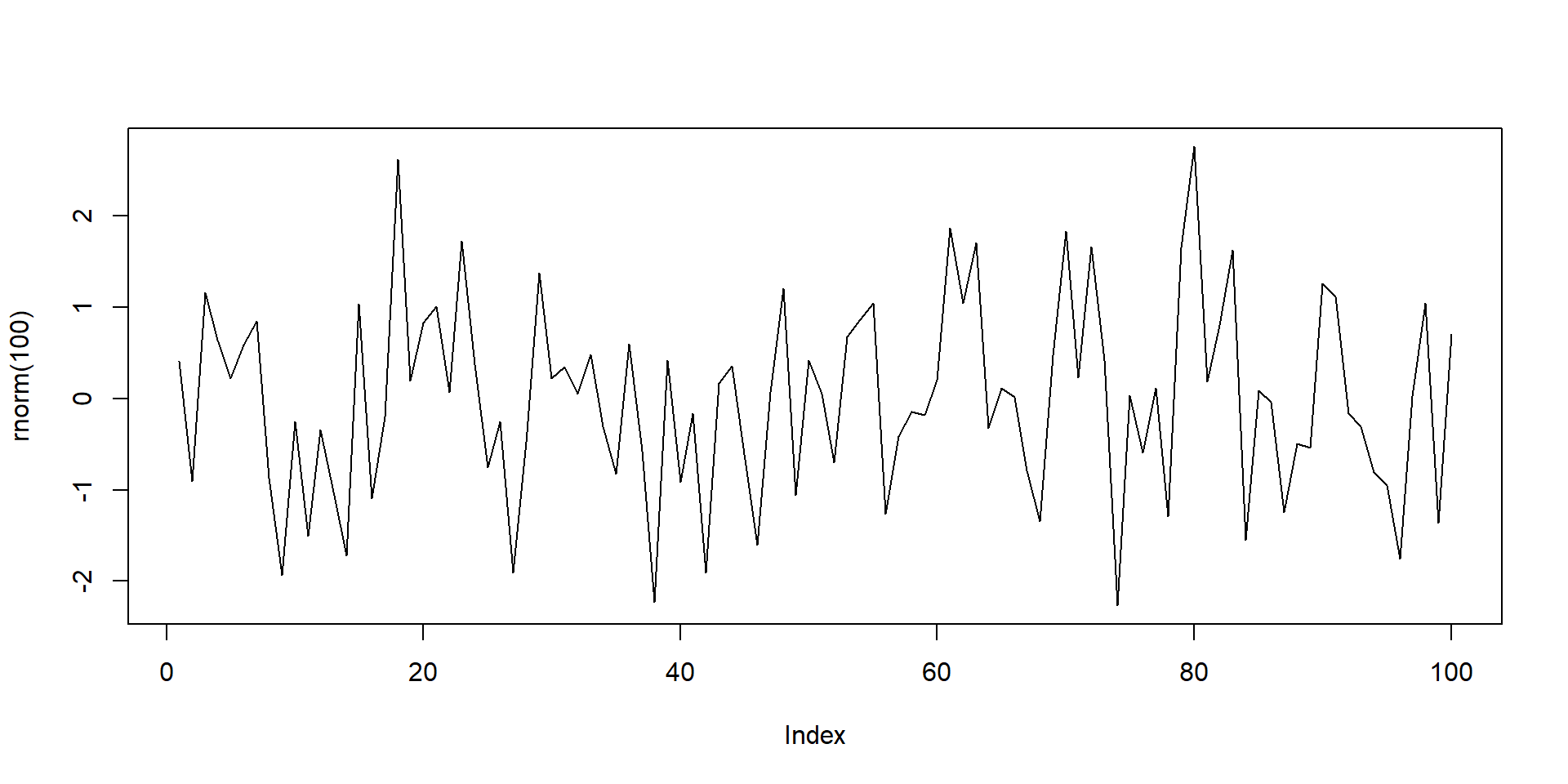

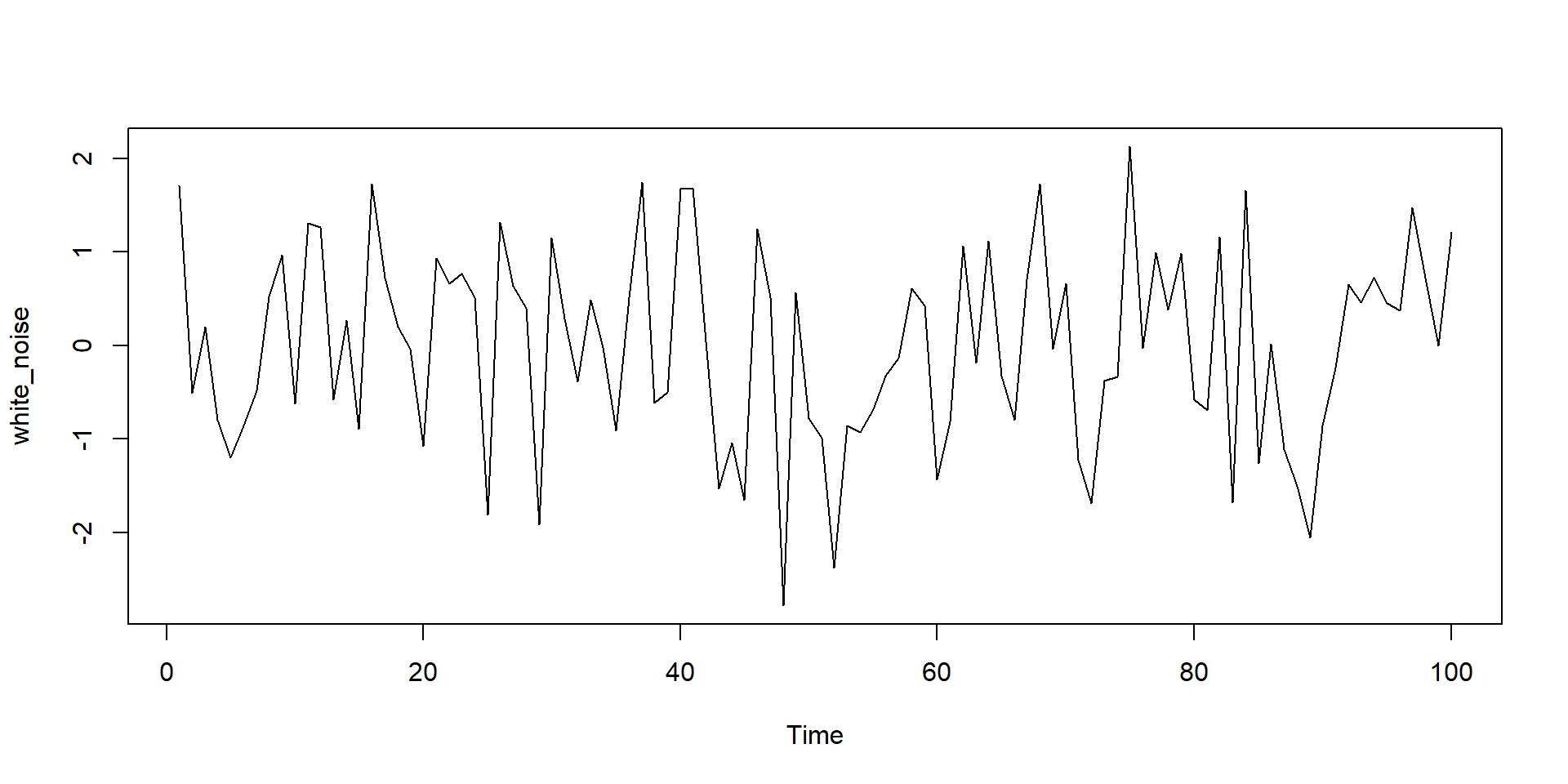

White Noise Process

- sequence of uncorrelated random variables from a fixed distribution

- i.i.d

\[\begin{equation} \begin{aligned} &E\left(y_{t}\right)=\mu=0 \\ &E\left(y_{t}-\mu\right)^{2}=Var(y_t)=\sigma_{\mu}^{2} \end{aligned} \end{equation}\]

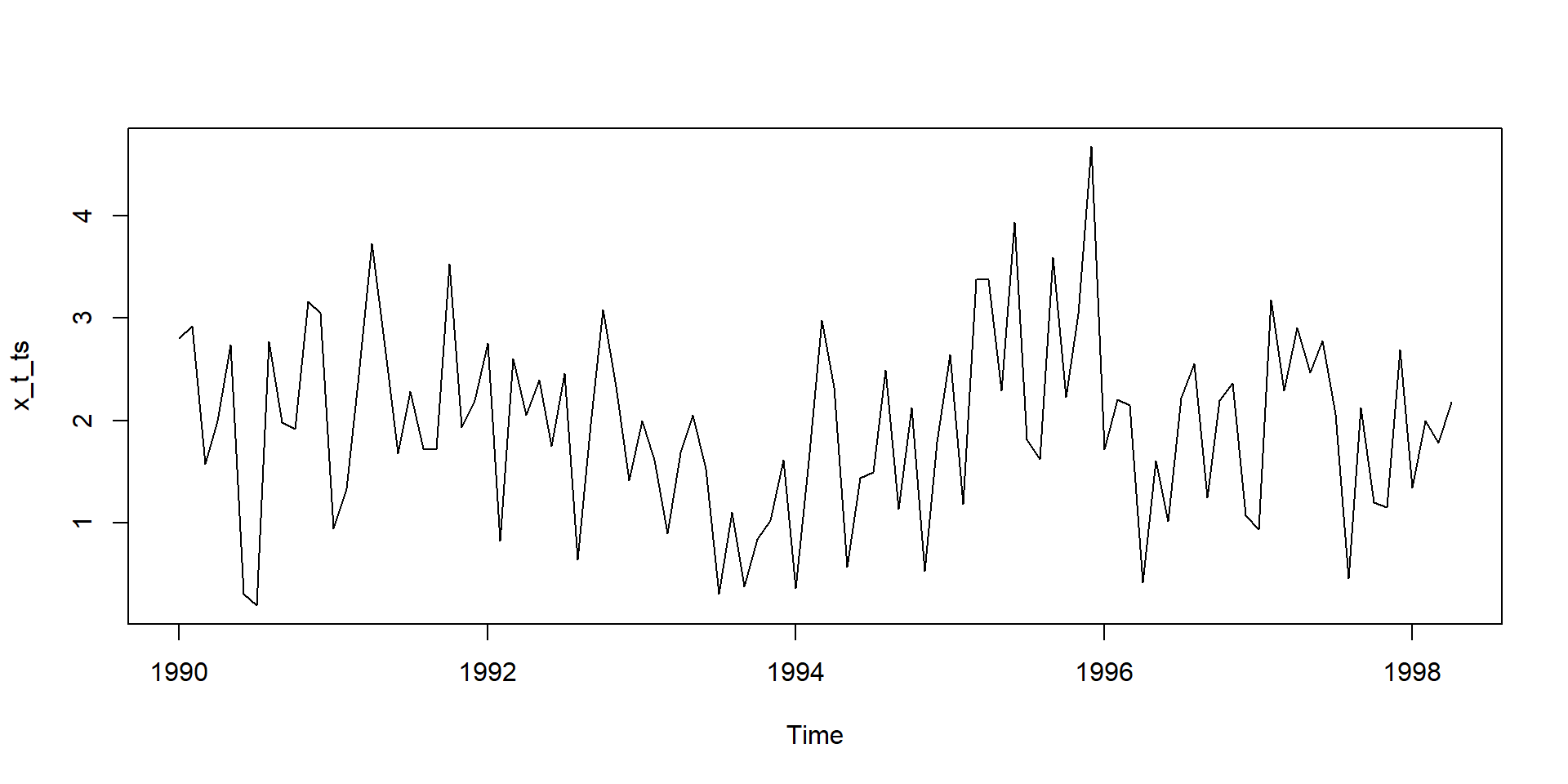

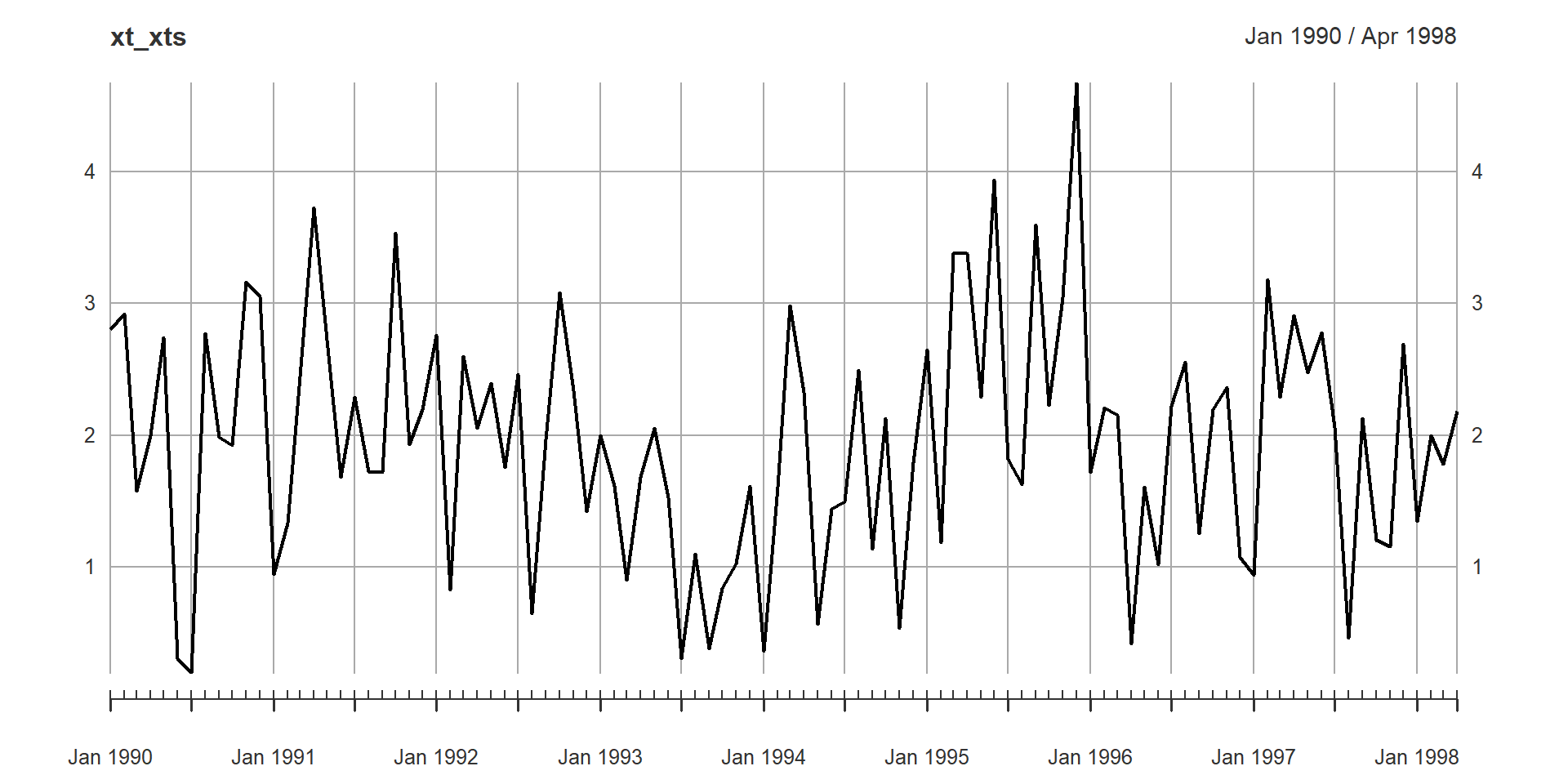

Simulation of Stationary process

Jan Feb Mar Apr May Jun Jul

1990 2.8020683 2.9212619 1.5770886 1.9989418 2.7409393 0.3056378 0.1948141

1991 0.9449564 1.3329852 2.4422355 3.7253519 2.7242018 1.6829168 2.2863954

1992 2.7568201 0.8296221 2.6016036 2.0512058 2.3952448 1.7532820 2.4596890

1993 1.9994651 1.6146232 0.8998874 1.6849335 2.0541027 1.5258560 0.3085585

1994 0.3601174 1.6095626 2.9820113 2.3244252 0.5675891 1.4373680 1.4970988

1995 2.6458915 1.1860944 3.3795775 3.3793787 2.2896724 3.9349686 1.8168275

1996 1.7202123 2.2061306 2.1530900 0.4199460 1.6099486 1.0203606 2.2224175

1997 0.9356408 3.1818449 2.2896916 2.9076898 2.4721116 2.7782292 2.0620099

1998 1.3474332 1.9972262 1.7807013 2.1818773

Aug Sep Oct Nov Dec

1990 2.7699693 1.9840060 1.9207495 3.1591849 3.0527548

1991 1.7277774 1.7189432 3.5322217 1.9321485 2.1946392

1992 0.6452703 1.9654789 3.0813508 2.3363887 1.4197945

1993 1.1028343 0.3825236 0.8409247 1.0223992 1.6148691

1994 2.4919466 1.1360051 2.1254101 0.5343036 1.7909002

1995 1.6267527 3.5949415 2.2261651 3.0460791 4.6742249

1996 2.5571245 1.2519367 2.1954782 2.3655836 1.0772995

1997 0.4591330 2.1296115 1.2022569 1.1535417 2.6936724

1998 [,1]

Jan 1990 2.8020683

Feb 1990 2.9212619

Mar 1990 1.5770886

Apr 1990 1.9989418

May 1990 2.7409393

Jun 1990 0.3056378

Jul 1990 0.1948141

Aug 1990 2.7699693

Sep 1990 1.9840060

Oct 1990 1.9207495

Nov 1990 3.1591849

Dec 1990 3.0527548

Jan 1991 0.9449564

Feb 1991 1.3329852

Mar 1991 2.4422355

Apr 1991 3.7253519

May 1991 2.7242018

Jun 1991 1.6829168

Jul 1991 2.2863954

Aug 1991 1.7277774

Sep 1991 1.7189432

Oct 1991 3.5322217

Nov 1991 1.9321485

Dec 1991 2.1946392

Jan 1992 2.7568201

Feb 1992 0.8296221

Mar 1992 2.6016036

Apr 1992 2.0512058

May 1992 2.3952448

Jun 1992 1.7532820

Jul 1992 2.4596890

Aug 1992 0.6452703

Sep 1992 1.9654789

Oct 1992 3.0813508

Nov 1992 2.3363887

Dec 1992 1.4197945

Jan 1993 1.9994651

Feb 1993 1.6146232

Mar 1993 0.8998874

Apr 1993 1.6849335

May 1993 2.0541027

Jun 1993 1.5258560

Jul 1993 0.3085585

Aug 1993 1.1028343

Sep 1993 0.3825236

Oct 1993 0.8409247

Nov 1993 1.0223992

Dec 1993 1.6148691

Jan 1994 0.3601174

Feb 1994 1.6095626

Mar 1994 2.9820113

Apr 1994 2.3244252

May 1994 0.5675891

Jun 1994 1.4373680

Jul 1994 1.4970988

Aug 1994 2.4919466

Sep 1994 1.1360051

Oct 1994 2.1254101

Nov 1994 0.5343036

Dec 1994 1.7909002

Jan 1995 2.6458915

Feb 1995 1.1860944

Mar 1995 3.3795775

Apr 1995 3.3793787

May 1995 2.2896724

Jun 1995 3.9349686

Jul 1995 1.8168275

Aug 1995 1.6267527

Sep 1995 3.5949415

Oct 1995 2.2261651

Nov 1995 3.0460791

Dec 1995 4.6742249

Jan 1996 1.7202123

Feb 1996 2.2061306

Mar 1996 2.1530900

Apr 1996 0.4199460

May 1996 1.6099486

Jun 1996 1.0203606

Jul 1996 2.2224175

Aug 1996 2.5571245

Sep 1996 1.2519367

Oct 1996 2.1954782

Nov 1996 2.3655836

Dec 1996 1.0772995

Jan 1997 0.9356408

Feb 1997 3.1818449

Mar 1997 2.2896916

Apr 1997 2.9076898

May 1997 2.4721116

Jun 1997 2.7782292

Jul 1997 2.0620099

Aug 1997 0.4591330

Sep 1997 2.1296115

Oct 1997 1.2022569

Nov 1997 1.1535417

Dec 1997 2.6936724

Jan 1998 1.3474332

Feb 1998 1.9972262

Mar 1998 1.7807013

Apr 1998 2.1818773White noise process in R

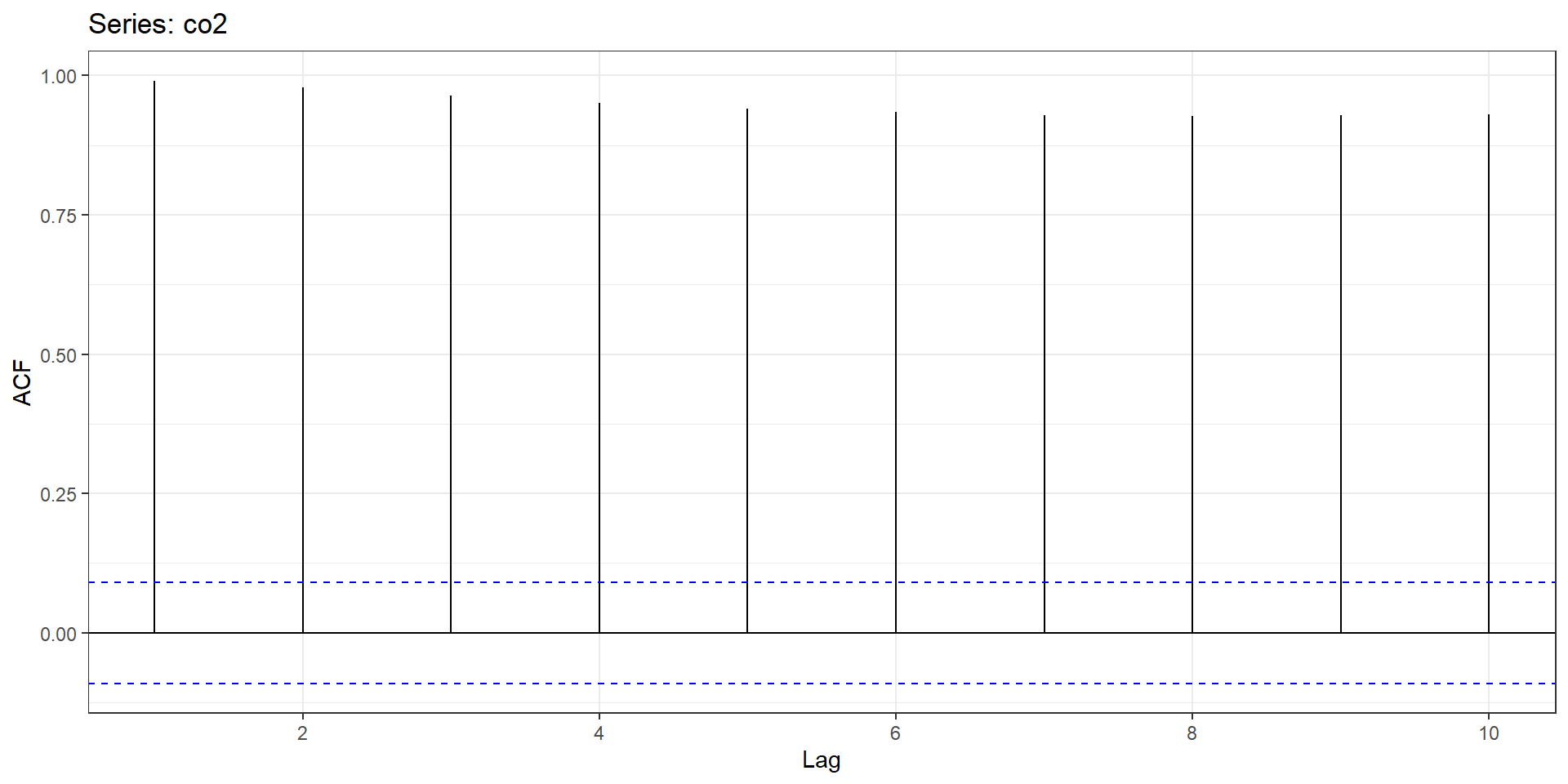

Autocorrelation and Autocovariance Functions

both as functions of only time differences \(|t-s|\)

Autocovariance \[\begin{equation} \gamma_{k}=\operatorname{Cov}\left(Z_{t}, Z_{t+k}\right)=E\left(Z_{t}-\mu\right)\left(Z_{t+k}-\mu\right) \end{equation}\]

Autocorrelation Function (ACF) \[\begin{equation} \rho_{k}=\frac{\operatorname{Cov}\left(Z_{t}, Z_{f+k}\right)}{\sqrt{\operatorname{Var}\left(Z_{f}\right)} \sqrt{\operatorname{Var}\left(Z_{t+k}\right)}}=\frac{\gamma_{k}}{\gamma_{0}} \end{equation}\]

Implementation in R

Univariate Time Series

Stationary Time Series

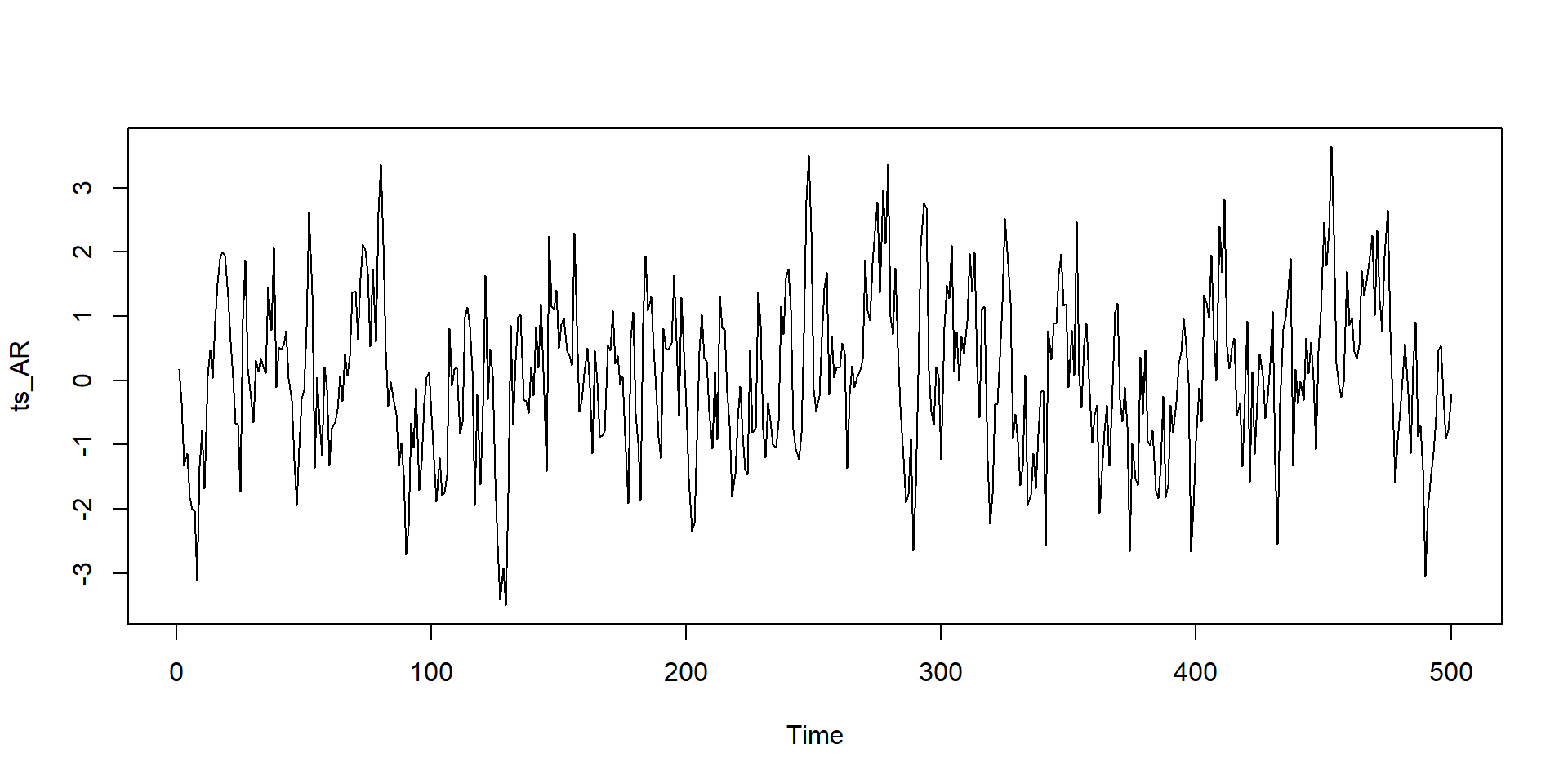

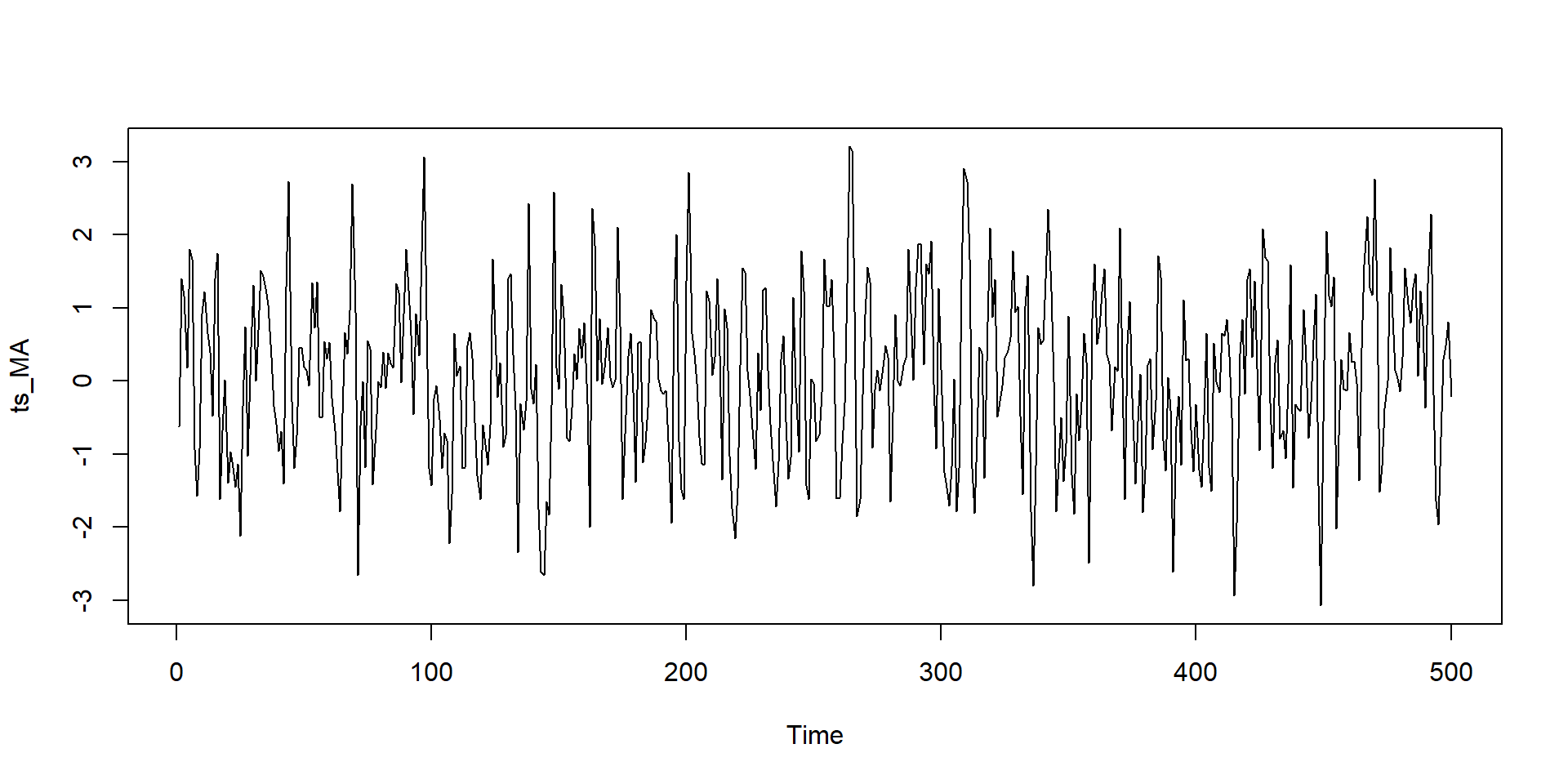

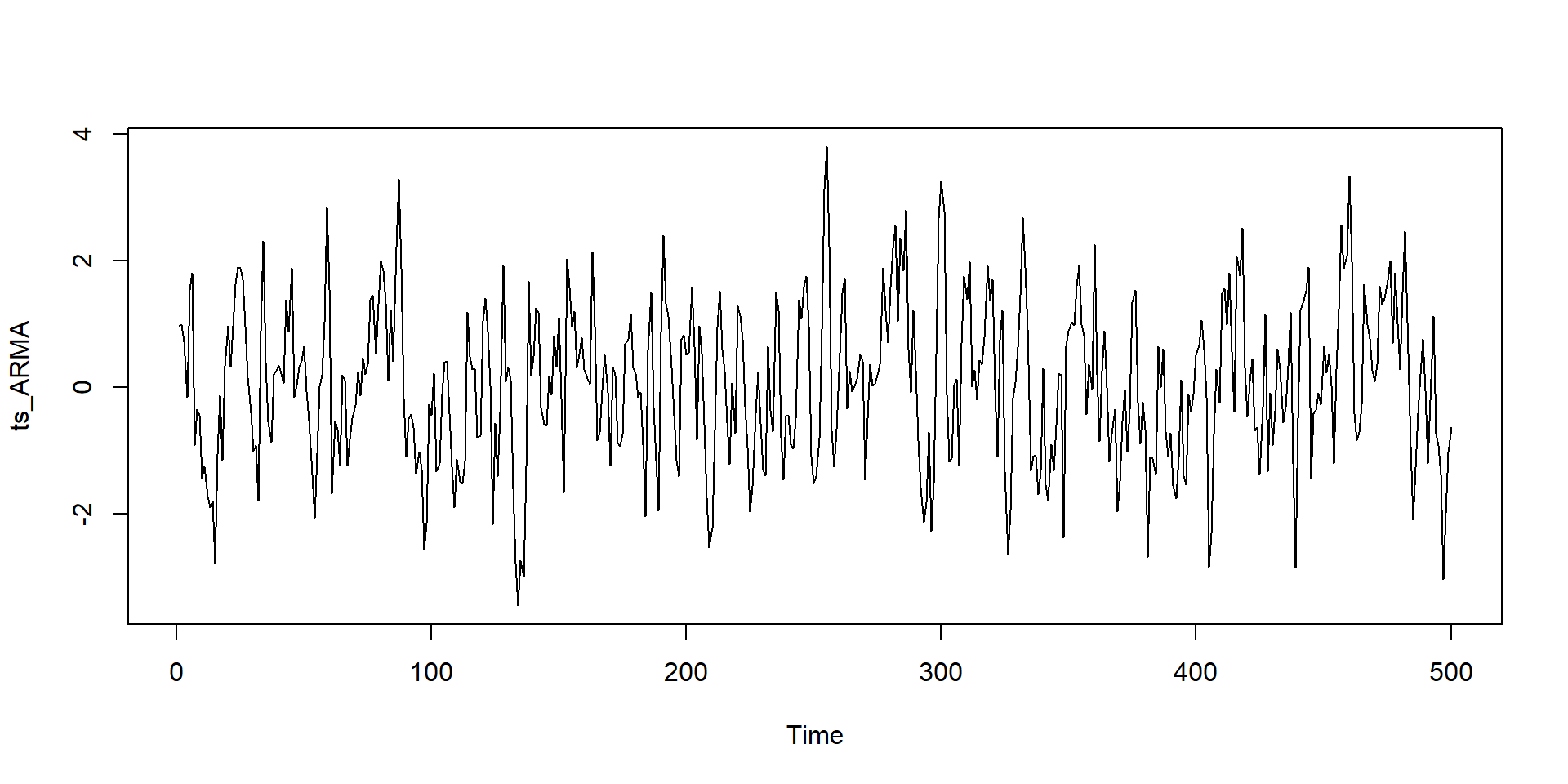

3 important process

Moving Average (MA) \[ y_{t}=\mu+u_{t}+\phi_{1} u_{t-1}+\phi_{2} u_{t-2}+\ldots+\phi_{t} u_{t} \]

Autoregressive (AR) \[ y_{t}=a+b_{1} y_{t-1}+b_{2} y_{t-2}+\ldots .+b_{p} y_{t}+\varepsilon_{t} \]

ARMA Process \[ \begin{aligned} &y_{t}=a+b_{1}y_{t-1}+b_{2}y_{t-2}+\ldots+b_{p}y_{t-p} \\ &+u_{t}+\phi_{1} u_{t-1}+\phi_{2} u_{t-2}+\ldots+\phi_{q} u_{t-q} \end{aligned} \]

Steps in analysis of stationary series

- Identification

- visual inspection

Formal identification

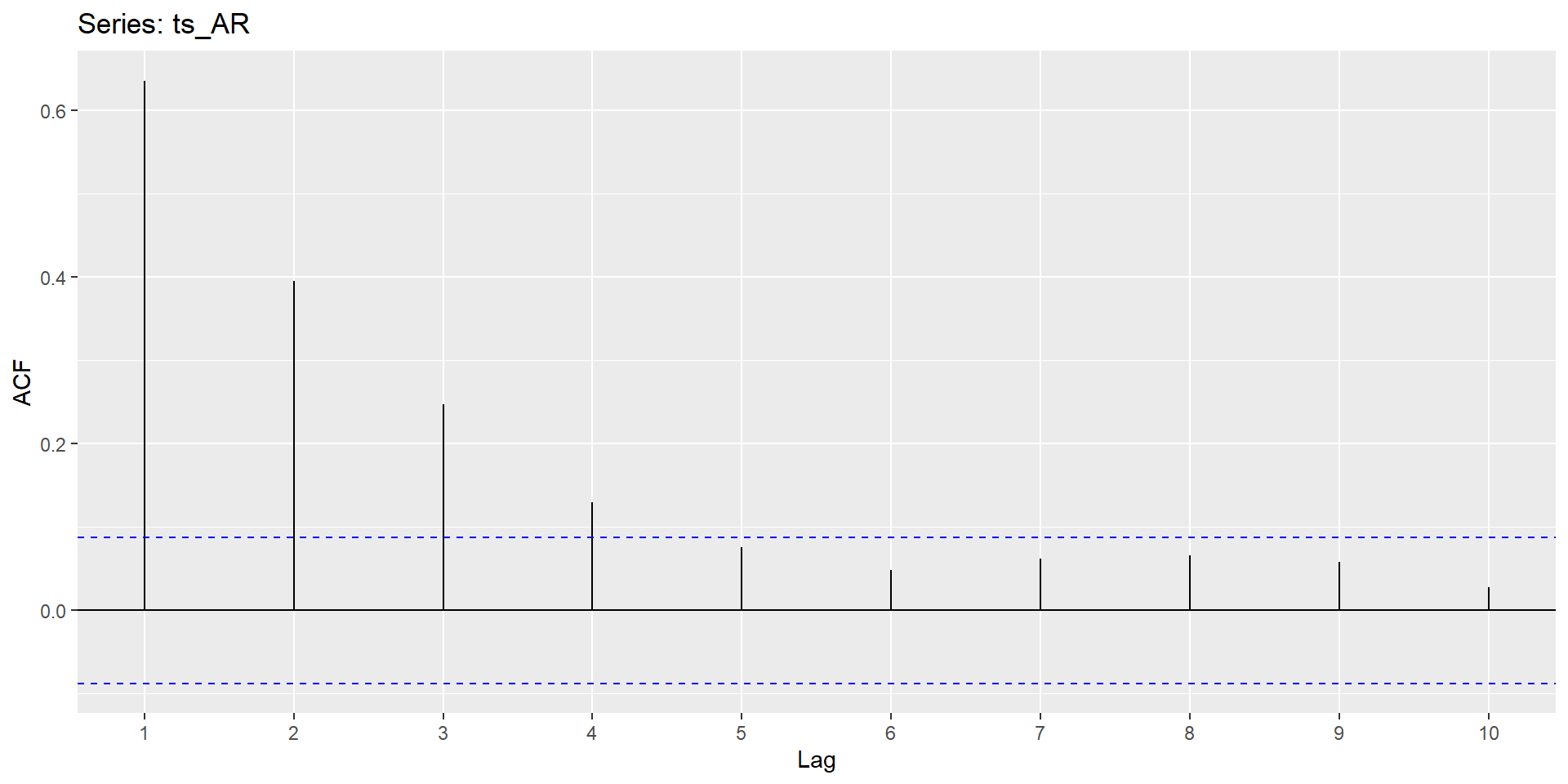

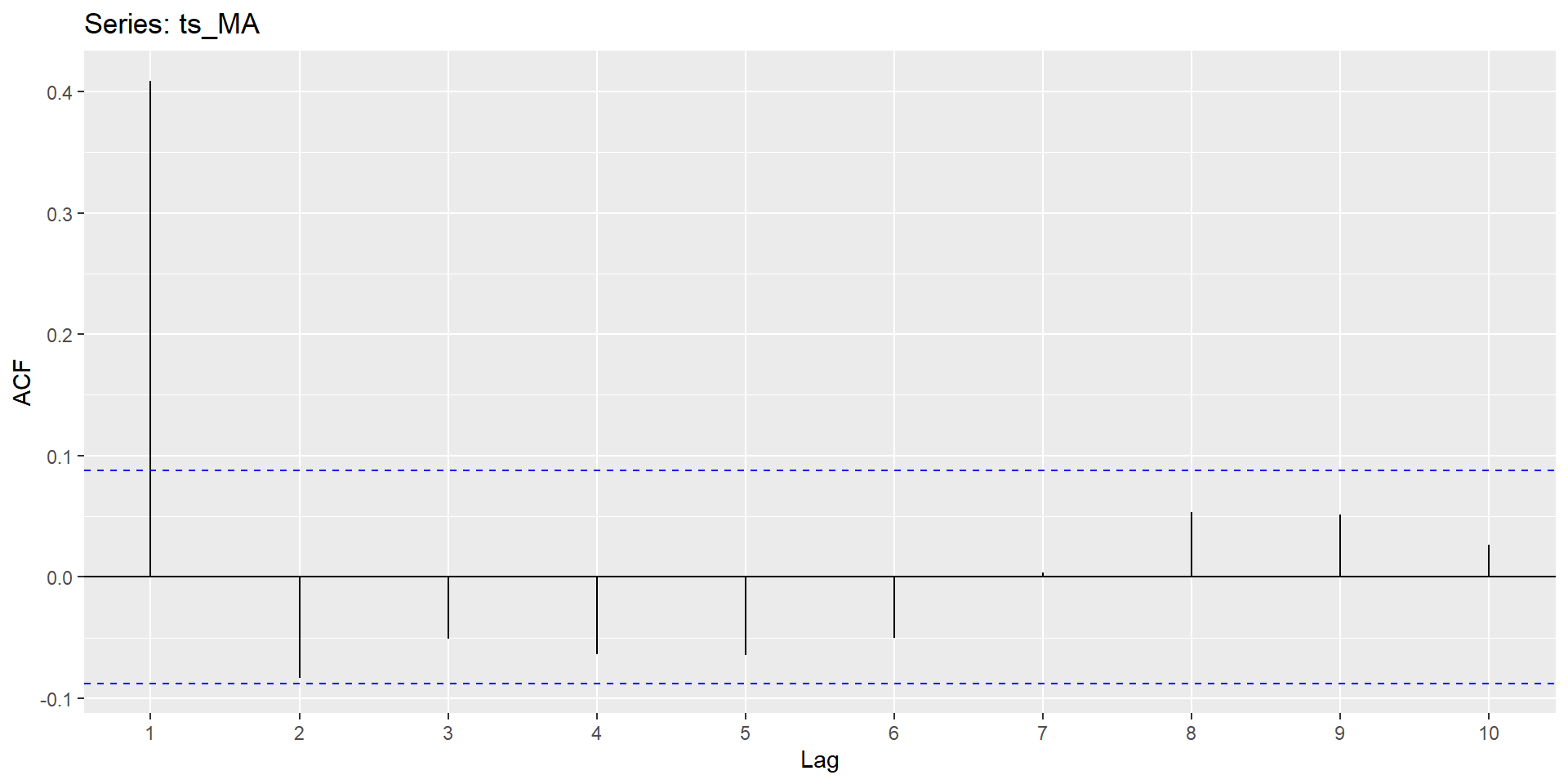

Autocorrelation Function

Formal identification (Cont.)

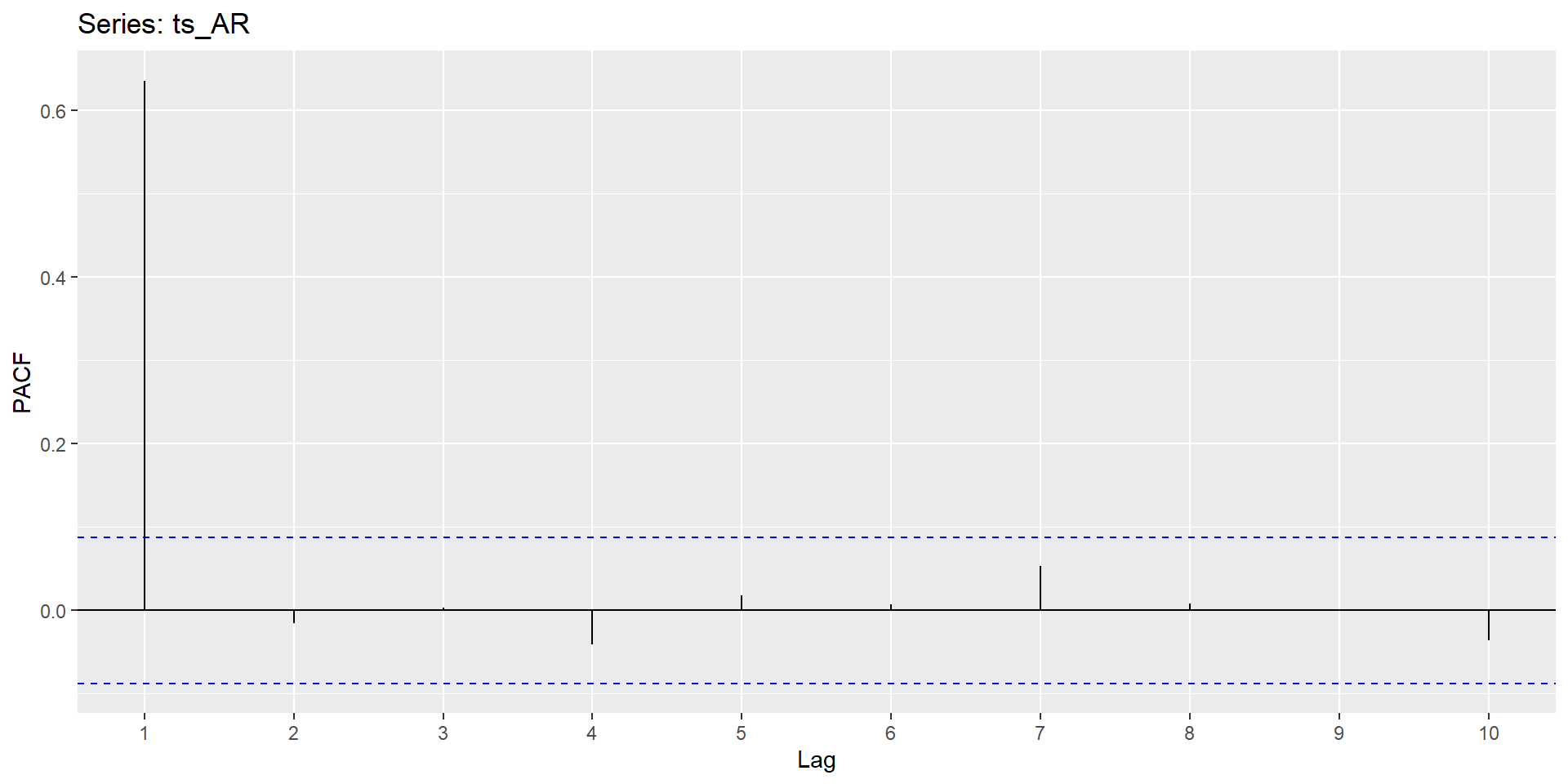

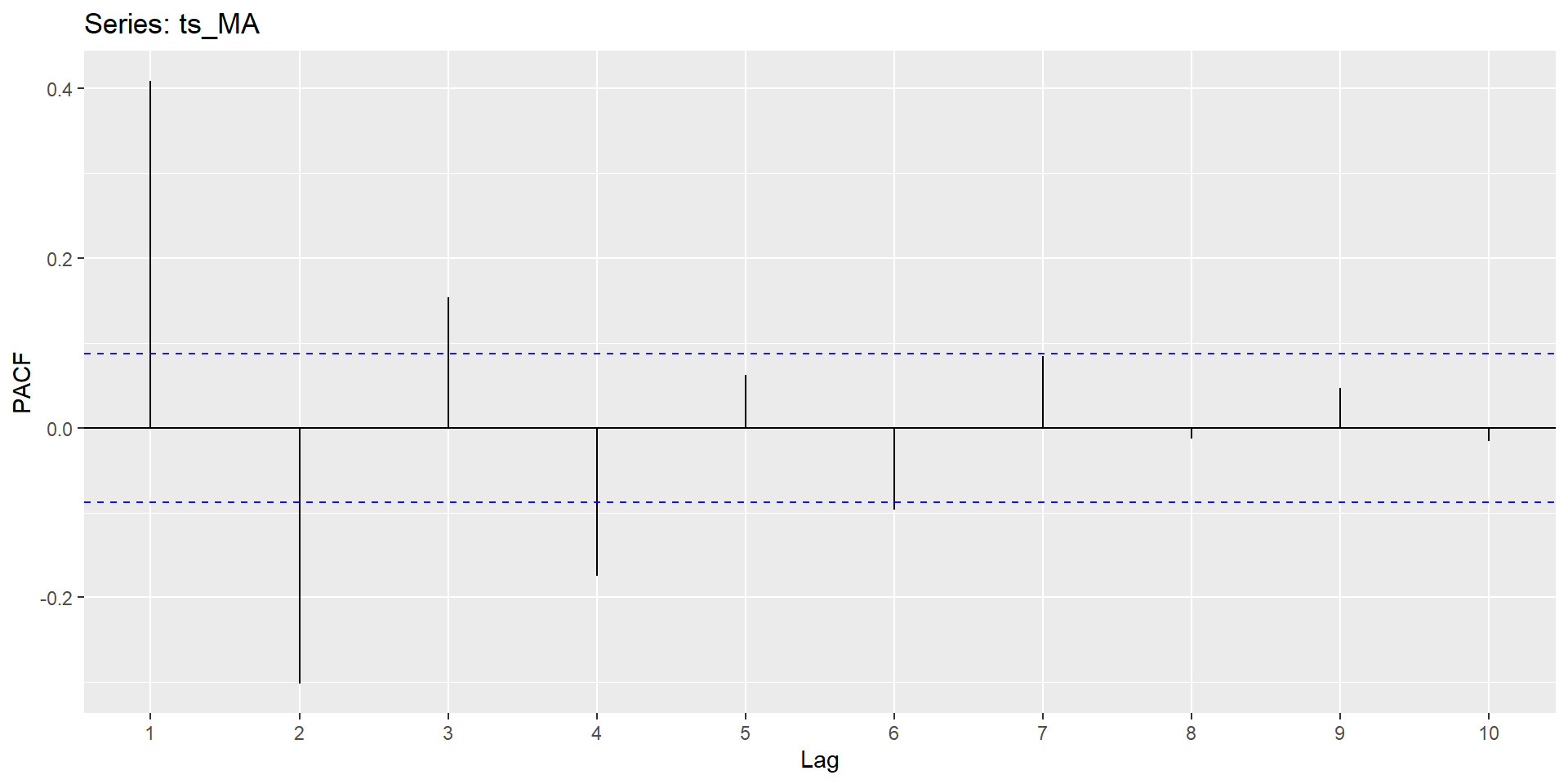

Partial Autocorrelation Function

Formal identification (Cont.)

Summary of Patterns to look for

Non-stationary Process

- A variable \(y_t\) is non-stationary, if it has time varying mean or time varying variance or both

- There is no mean reversion

- 3 types

- Random Walk without drift

- Random walk with drift

- Random walk with drift and deterministic trend

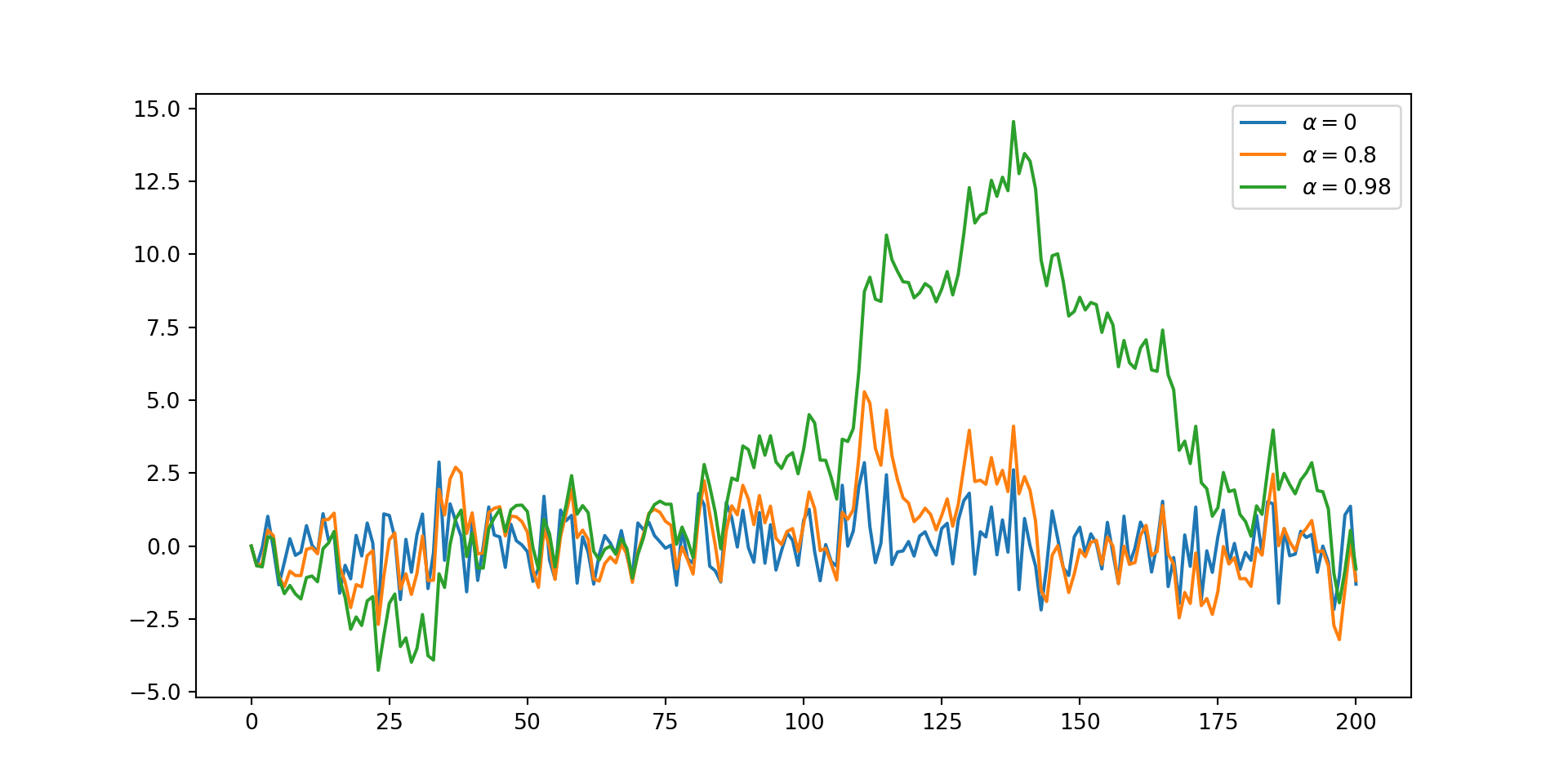

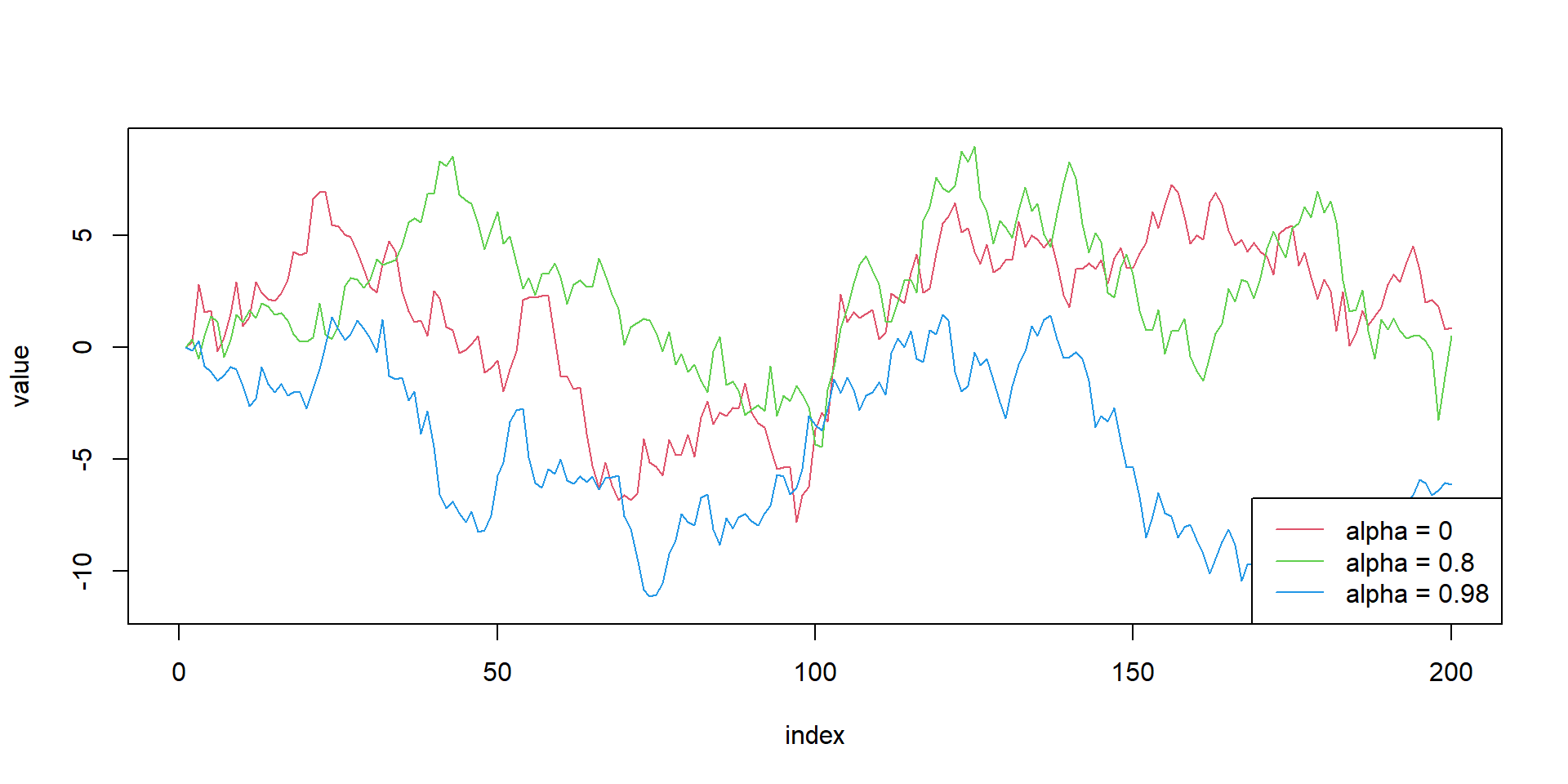

Random walk - Simulation

# Set-up

alphas<-c(0,0.8,0.98)

obs<-array(0,200)

list_rw<-list()

for(m in 1:3){

for(i in alphas){

for (j in 2:length(obs) ){

obs[j]=i*obs[j-1]+rnorm(1)

}

}

list_rw[[m]]<-obs

}

#limit calculation

ymax=max(sapply(list_rw,max))

ymin=min(sapply(list_rw,min))

#empty plot

plot(NULL, xlab = "index", ylab = "value", xlim = c(0, length(obs)), ylim = c(ymin,ymax))

#plot lines

for(i in seq_along(list_rw)){

lines(x=1:200,y=list_rw[[i]], type = "l", lty = 1, col = i +1 )

}

# Legends

legend("bottomright", legend = paste0("alpha = ", alphas), lty = 1, col = 1 + seq_along(alphas))

Integrated Stochastic Process

RWP is non-stationary but its first difference is stationary \[\begin{equation} \begin{aligned} &y_{t}=y_{t-1}+\varepsilon_{t} \\ &\Delta y_{t}=\varepsilon_{t} \end{aligned} \end{equation}\]

\(y_t\) is said to be integrated of order 1 (\(y_{t} \sim I(1)\))

simillarly, \(y_t \sim I(2)\) if \(\Delta^{2} y_{t}=\varepsilon_{t}\)

Consequences of Non-Stationarity

- Shocks do not “die” out

- Statistical consequences

- Non normal distribution of test statistics

- Bias in AR coefficients

- Poor forecasts

- Spurious Regression

Testing for Non-Stationarity

- Unit root problem

- Conventional Unit root tests

- DF test

- ADF test

- PP test

- DF GLS test

- Unit root with structural breaks

- KPSS stationarity test

Where do we go from here??

Advanced Topics

- ARIMA models

- Modelling Volatility- ARCH/GARCH class of models

- Multivariate time series - VAR/VECM

- Non-linear time series - TAR/SETAR, MRS, KF

Practical Time Series in R

Loading Data

- a

Rdataframe is not a time series object by defauls - need packages like

xts,zoo,tsibbleetc., to handle time series data

# A tibble: 12 × 2

date value

<date> <int>

1 2020-01-01 3821

2 2020-02-01 3262

3 2020-03-01 3219

4 2020-04-01 4039

5 2020-05-01 3004

6 2020-06-01 3151

7 2020-07-01 4903

8 2020-08-01 3695

9 2020-09-01 4138

10 2020-10-01 3681

11 2020-11-01 4568

12 2020-12-01 3115- observe the date column; not a time series object yet

- this is just a regular dataframe with a date column

Converting to time series object

# A tsibble: 12 x 2 [1D]

date value

<date> <int>

1 2020-01-01 3821

2 2020-02-01 3262

3 2020-03-01 3219

4 2020-04-01 4039

5 2020-05-01 3004

6 2020-06-01 3151

7 2020-07-01 4903

8 2020-08-01 3695

9 2020-09-01 4138

10 2020-10-01 3681

11 2020-11-01 4568

12 2020-12-01 3115# A tsibble: 12 x 2 [1M]

date value

<mth> <int>

1 2020 Jan 3821

2 2020 Feb 3262

3 2020 Mar 3219

4 2020 Apr 4039

5 2020 May 3004

6 2020 Jun 3151

7 2020 Jul 4903

8 2020 Aug 3695

9 2020 Sep 4138

10 2020 Oct 3681

11 2020 Nov 4568

12 2020 Dec 3115Some Data

Load the data gh_data.csv - some cleaning - pivoting and making tidy data - converting to tsibble - gaps in data

Now load the sales.csv

- handling gaps in the data

Working Dates and Time

- conversion of date-time formats

- date arithmetic

parse_date_timefromlubridatepackage

Time series features

- calender features

- lagged features

- differenced features

- visualisation

Exploratory Time Series Analysis

Why Exploratory Analysis Matters

Pattern Discovery: Uncover seasonal patterns, trends, and cycles that drive your time series.

Anomaly Detection: Identify outliers and unusual events that might distort your model.

Model Selection: Understand the type of forecasting method that might work best for your data.

Business Insights: For financial time series data you can transform raw numbers into actionable intelligence.

Data Quality: Catch any data issues before they compromise your analysis.

Visual Exploration

ggplot2package for visualisationautoplotfunction fromfeastspackage

Exploring Patterns

- Trend analysis

- Seasonal patterns

- Cyclical patterns

- Irregular components

- AR, MA, ACF, PACF plots

Forecasting

Forecasting Methods

use of fable package for forecasting

- Naive Forecasting

- Mean Forecasting

- Seasonal Naive Forecasting

- ETS

- ARIMA

- SARIMA

Putting it all together

- load `gh_cocoa.csv’ data

- fit some models

Let us have fun with time series!!

Thank You!

https://github.com/nithinmkp/flame-economiga